Whether you are the landlord or tenant, understanding the differences between a gross “inclusive” lease and the various “net” leases is important as there are pros and cons to both, depending which side of the transaction you are on.

As landlord, a large part of your success will be based on the types of business and individuals you attract as tenants and how you build and manage your relationships with them throughout the duration of the contract. As a tenant, you are seeking a space that will help you create a strong customer base by having a long-term, established location to operate from.

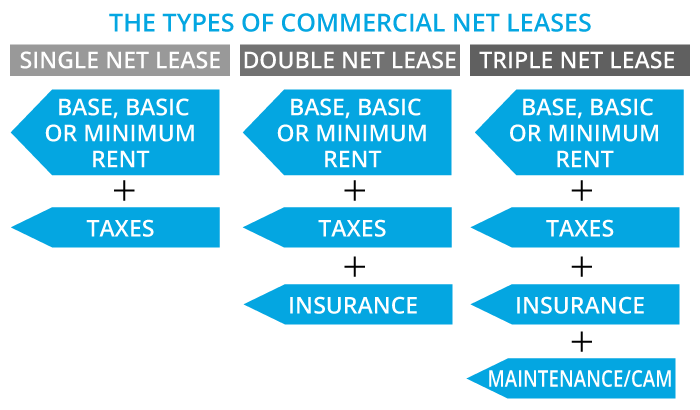

Below is a quick glance at the basic differences between single, double, and triple net leases.

Gross leases are based on a tenant paying rent based upon a set amount for the use of the property each month and do not require the tenant to cover any expenses, taxes, or insurance associated with the building since they are “built in” the price. While the sticker price may be higher than NNN, as tenants, gross leases are attractive since there is a fixed amount regardless whether their operating costs increase or not. Tenants need to read contracts carefully and check to see if there is a base year expense stop. Base year expense stops allow landlords to increase rent should their building operation expenses increase. For the landlord, this lease structure could cause issues due to uninvested tenants, unexpected tax increases and fees related to the property, and profit loss due to vacancy.

Net leases have advantages for owners and investors because operating expenses and taxes are passed onto the tenants, attracting more vested tenants, long-term leases with steady, reliable income, investment stability and asset flexibility – not to mention less management and oversight of property expenses. In this type of structure, tenants need to know that there are still common area maintenance (CAMs) costs to cover. It is always important to READ everything CAREFULLY. Each net lease can have different ways to account for certain costs such as building administration, maintenance, and management fees.

There is no “one fits all” when it comes to leases whether you are the one offering or accepting an agreement. The best choice for leasing option types will depending on what the circumstances and conditions are surrounding a building or business owner.

If you have space to lease out or looking for space to occupy, contact CLG Realty Advisors today.